The Tropical Forest Forever Facility (TFFF) is a proposed global, permanent fund designed to support the long-term conservation of tropical forests. Spearheaded by the Government of Brazil, in dialogue with 11 other countries, the initiative is scheduled to be formally launched at COP 30 in Belém, Brazil.

Unlike traditional conservation finance efforts that often rely on new donor pledges, the TFFF proposes an innovative approach. It mobilizes investments from governments, sovereign wealth funds and institutional investors to create a long-term investment facility that generates annual payments for forest conservation.

The Purpose of the TFFF: A Fund that Fights Deforestation

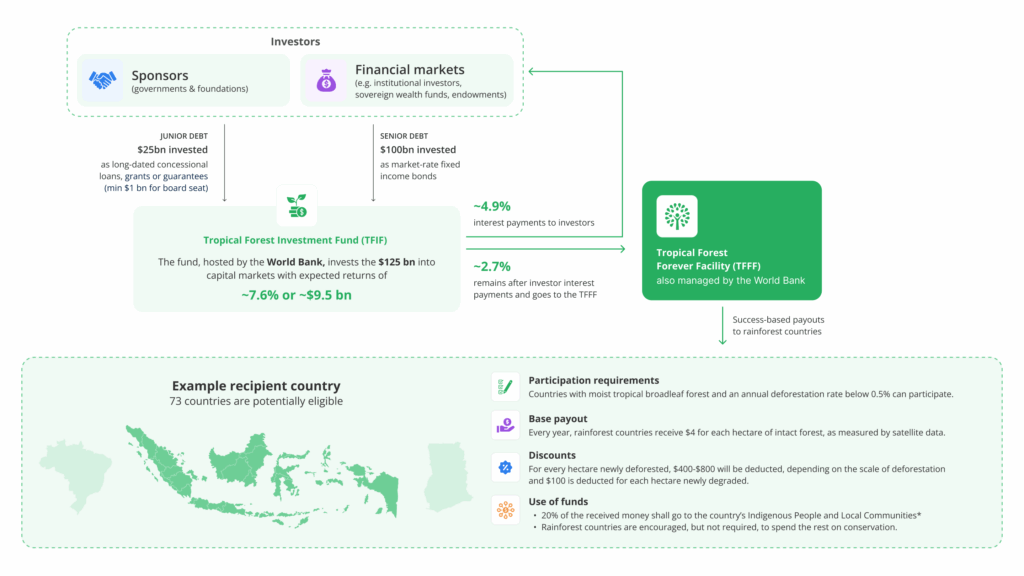

First introduced at COP 28, the TFFF proposes to raise $125 billion in capital. The fund’s core objective is to reward countries that are already maintaining or reducing deforestation rates but require ongoing financial support to continue doing so. More than 140 countries pledged at COP 26 in Glasgow to end deforestation by 2030. Current deforestation rates show that we are not on track to meet this goal. The TFFF seeks to address this shortfall by offering a long-term, performance-based funding model that rewards forest conservation. Under the proposed model, tropical forest countries can receive annual payments of $4 per hectare of preserved forest. However, payments are subject to deductions:

- $400-$800 are deducted per hectare deforested

- $100 per hectare degraded

The TFFF is proposed to be structured as a two-arm facility, most likely managed by the World Bank:

- The Tropical Forest Investment Fund (TFIF): which will serve as the financial engine, mobilizing capital through a blended finance model and investing it in low-risk, fixed-income instruments such as government bonds.

- The Tropical Forest Facility (referred to simply as “the Facility”): which will oversee the implementation of the reward system that channels payments to eligible tropical forest countries (TFCs).

These two arms will be coordinated by a central secretariat that ensures coherence between fund management and conservation outcomes. Each arm will be managed by separate trustees to maintain independent financial oversight. However, a single institution may perform both roles if strict separation of accounts is upheld.

The structure and governance of the TFFF*.

The TFFF Financing Approach for Forests

The TFFF is intended to operate as a blended finance model, structured to include a sponsor tranche and a senior debt tranche.

- The $25 billion sponsor tranche will consist of long-term loans, guarantees, or grants. These will be provided by high-income countries and other supporters, with repayment terms tied to the yield of long-term U.S. Treasury notes.

- The remaining $100 billion senior debt tranche will be raised from institutional investors through bond issuance. The goal is to offer a risk profile and return comparable to multilateral development bank (MDB) debt. The fund will be independently managed and will engage the World Bank as its treasury and financial manager.

TFIF’s investment strategy will prioritize climate- and sustainability-linked assets. These investments will focus on countries eligible for Official Development Assistance (ODA), such as green, blue, or sustainability bonds. This supports alignment with global climate finance goals like the New Collective Quantified Goal (NCQG). If sufficient ODA-eligible investments are not available, the TFIF will invest in more traditional sovereign and corporate debt. However, it will avoid any issuers included on a pre-agreed negative list. Up to 25 percent of the fund may be allocated to fixed-income instruments issued by non-ODA-eligible countries. This ensures some flexibility in portfolio construction while maintaining a focus on development.

Expected Impact and Global Significance of the TFFF

The TFFF represents a major shift in how the global community approaches financing for forest conservation. Its simplicity – offering a flat payment per hectare for preserved forests – and its strong penalty mechanism (with a 100:1 ratio for deforestation losses) provide clear and transparent incentives for forest countries. This approach contrasts with more complex mechanisms like REDD+, which rely on intricate carbon accounting. Others, like payment for ecosystem services (PES) schemes, focus on specific management practices.

The TFFF has the potential to become the largest single source of conservation finance in history. Its expected contributions to global climate stability, biodiversity protection, and improved livelihoods for forest-dependent communities mark it as a potentially transformative model.

*Based on the TFFF Concept Note 2.0, 16 May 2025.